Dates: 1 - 2 August 2024

Level: Intermediate

Duration: 2 days

Venue: Singapore University of Social Sciences

The Generative Artificial Intelligence (AI) in Finance course offers a comprehensive exploration of the intersection between artificial intelligence and the financial services industry. The course provides attendees with an in-depth understanding of Generative Artificial Intelligence (AI) techniques and their applications within the context of financial analysis, prediction, and decision-making.

The course begins by establishing a solid foundation in both Generative Artificial Intelligence (AI) and finance principles. It then delves into various Generative Artificial Intelligence (AI) methods, including Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and Transformers, while emphasizing their specific relevance to financial data.

Who Should Attend

Professionals and Advisors interested in understanding the FinTech Start-up Ecosystem and the start-ups’ approach to building and growing companies.

- An introduction to Artificial Intelligence (AI) and Generative Artificial Intelligence (AI)

- Generative Artificial Intelligence (AI) use cases in finance

- Hands-on programming of Generative Artificial Intelligence (AI)

- Benefits and Challenges of using Generative Artificial Intelligence (AI) in finance

- Future trends of Generative Artificial Intelligence (AI) in finance

- Understanding the fundamentals of Generative Artificial Intelligence (AI) and its application in finance

- Implementing and adapting Generative Artificial Intelligence (AI) models to financial data

- Developing solutions for fraud detection with Generative Artificial Intelligence (AI)

- Interpreting and communicating the results of Generative Artificial Intelligence (AI) models to financial professionals

Learning Outcomes

At the end of this course, participants should be able to:

- To improve understanding of change and change management for sustainability

- To plan and perform change processes

- To manage resistance to change

A. Knowledge and Understanding (Theory Component)

By the end of this course, participants should be able to:

- Illustrate the key concepts and methods of Generative Artificial Intelligence (AI)

- Discuss how Generative Artificial Intelligence (AI) can be used in real-world financial problems

- Identify benefits, challenges, and the future trends of Generative Artificial Intelligence (AI) in finance

B. Key Skills (Practical Component)

By the end of this course, you should be able to:

- Develop Generative Artificial Intelligence (AI) code to solve financial problems

- Explain the results of Generative Artificial Intelligence (AI) code to financial professionals

| Time | Agenda |

|---|

| Day 1 |

| 09:00 - 09:30 | Course overview |

| 09:30 - 10:30 | Key concepts of Artificial Intelligence (AI) |

| 10:30 - 10:45 | Break |

| 10:45 - 12:00 | An introduction to Generative Artificial Intelligence (AI) |

| 12:00 - 13:00 | Lunch |

| 13:00 - 15:30 | Use cases of Generative Artificial Intelligence (AI) in finance |

| 15:30 - 15:45 | Break |

| 15:45 - 17:00 | Benefits and challenges of Generative Artificial Intelligence (AI) in finance |

| Time | Agenda |

|---|

| Day 2 |

| 09:00 - 09:30 | Recap of Day 1 |

| 09:30 - 10:30 | Programming using Jupyter Notebook |

| 10:30 - 10:45 | Break |

| 10:45 - 12:00 | Hands on programming of Generative Artificial Intelligence (AI) (part 1) |

| 12:00 - 13:00 | Lunch |

| 13:00 - 15:30 | Hands on programming of Generative Artificial Intelligence (AI) (part 2) |

| 15:30 - 15:45 | Break |

| 15:45 - 17:00 | The future trends of Generative Artificial Intelligence (AI) |

| 17:00 – 17:30 | Assessment |

*SUSS reserves the right to change the course dates, topics and trainers.- Participants should have a basic understanding in Artificial Intelligence (AI) and finance.

- Participants must bring along their own laptops for the hands-on programming.

Dr Ding Qinxu is a researcher in applied AI and FinTech. As an academic, he has published and presented at various top AI conferences, such as NeurIPS, ICLR, AAAI, and CIKM. He has also published FinTech Journals in large language models (LLMs) and blockchain technologies. Currently, his research focuses on explainable AI and LLMs. He is working as a lecturer in the Finance program at the School of Business at SUSS. He teaches Machine learning and AI in FinTech and Deep Neural Network courses at SUSS.

Before joining SUSS, Dr Ding Qinxu was a research fellow at Alibaba NTU Joint Research Institute. He participated in projects using explainable AI to provide feasible actions for bank loan applications and applying a diversified recommender system to recommend novelty and relevant items to Taobao’s customers. He obtained a Ph.D. in Electrical and Electronic Engineering at NTU and a bachelor’s degree in computational mathematics at Nankai University, China.

Please submit the following documents to cet@suss.edu.sg:

- Coloured copy (back and front) of NRIC for Singaporeans and PRs, or "Employment"/"S" Pass for foreign applicant

- Application form

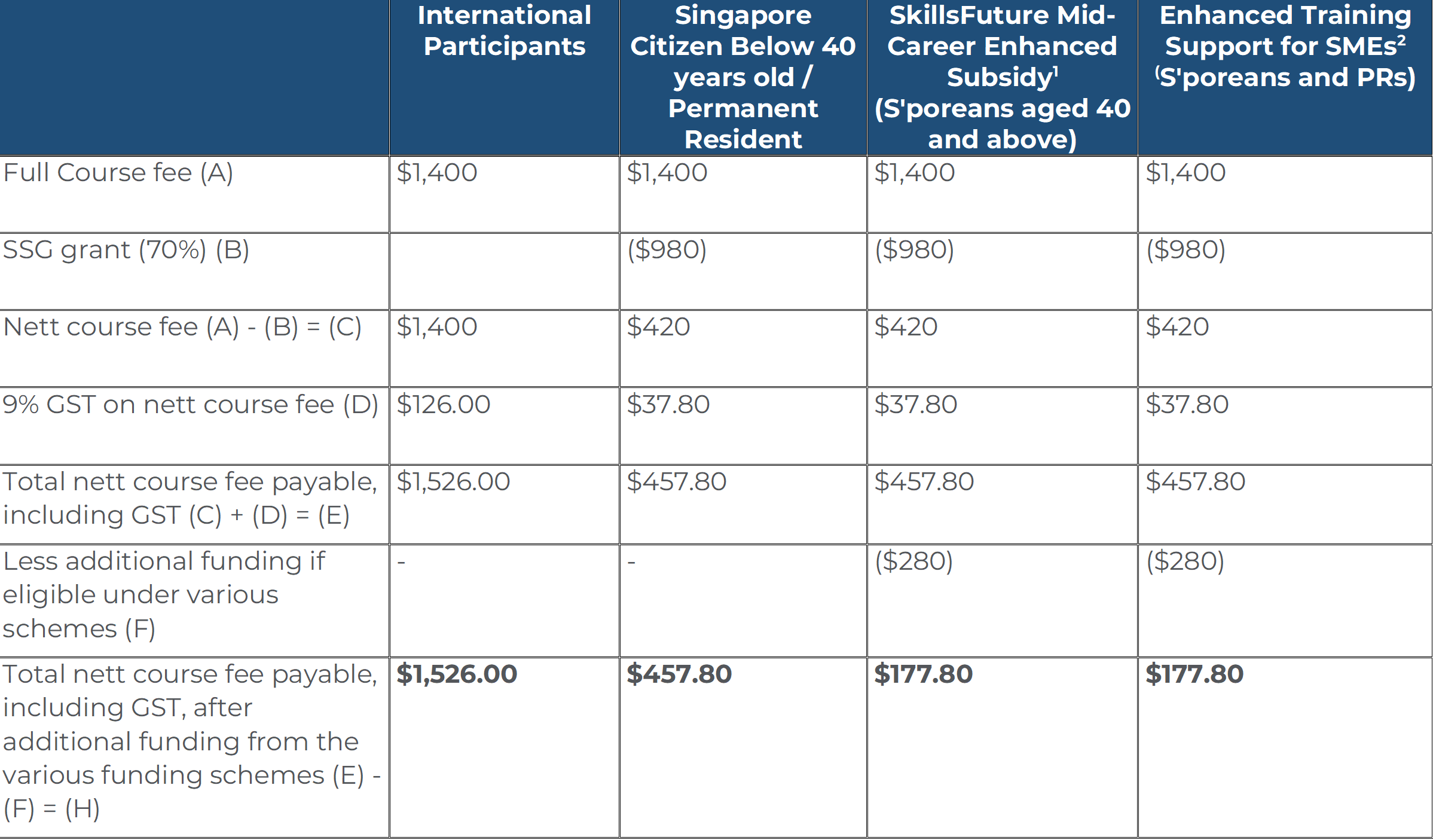

Course Fee

1 Mid-Career Enhanced Subsidy: Singaporeans aged 40 and above may enjoy subsidies up to 90% of the course fees.

2 Enhanced Training Support for SMEs: SME-sponsored employees (Singaporean Citizens and PRs) aged 21 and above may enjoy subsidies up to 90% of the course fees.

Participants are required to achieve at least 75% attendance and pass any prescribed examinations/assessments or submit any course/project work (if any) under the course requirement.

Participants are required to complete all surveys and feedbacks related to the course.

The course fees are reviewed annually and may be revised. The University reserves the right to adjust the course fees without prior notice.

Singapore University of Social Sciences reserves the right to amend and/or revise the above schedule without prior notice.

For clarification, please contact the SUSS Academy via the following:

Telephone: +65 6248 0263

Email:

CET@suss.edu.sg