The Bachelor of Science in Finance programme is designed to cater to professionals already working in the financial sector who are seeking to elevate their skills or broaden their career horizons. Additionally, it is well-suited for individuals aiming to transition into finance from other fields. Structured to facilitate a gradual progression of financial expertise, the programme offers students a comprehensive understanding of key areas such as trading, investment, financial markets, financial institutions, portfolio management, and risk management. Through this structured approach, students can effectively develop and refine their financial knowledge and skill sets.

Unique Features of the Programme The programme maintains robust ties with the finance industry, ensuring that its knowledge content remains current and relevant to the latest developments. We collaborate closely with esteemed industry partners such as the Chartered Financial Analyst (CFA) Institute and the Chartered Alternative Investment Analyst (CAIA) Association1, as well as the Financial Planning Association of Singapore (FPAS)2.

Through these alliances, we ensure that our curriculum is aligned with industry standards and practices, equipping our students with the most up-to-date knowledge and skills required for success in the dynamic world of finance.

With the embrace of the interdisciplinary perspectives offered by the SUSS Core, the student's academic journey is enriched, and critical thinking skills are cultivated, empowering the navigation of diverse social landscapes with empathy, insight, and informed perspectives.

1: CFA's Investment Foundations Certificate and CAIA's Fundamentals of Alternative Investments Certificate are credit recognised for 2.5 cu each at Level 2.2: Students in the finance programme who pass FIN379 are exempted from Modules 1 to 5 of the Certified Financial Planner (CFP) Certification examinations administered by FPAS. Students not in the finance programme who pass FIN379 are exempted only from Modules 1, 2, 3 and 5.

Pathway

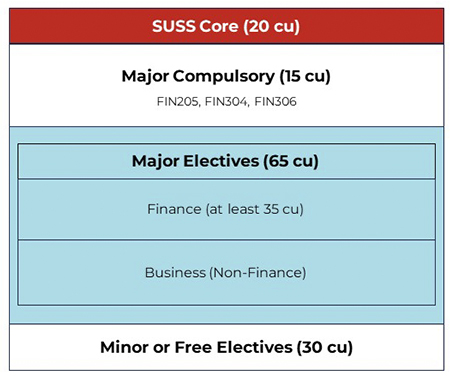

Students may pursue Finance as a single major or in a combination with a minor.

Pursuing a minor presents students with a valuable opportunity to cultivate a versatile skill set that transcends disciplinary boundaries— a crucial asset in today's rapidly evolving, knowledge-driven economy. By embracing this interdisciplinary approach, students can distinguish themselves and position themselves for success in a competitive landscape.

Students will decide on the pathway as they progress academically. The flexible structure of the programme allows students to deepen or broaden their course selections to suit their personal preferences, interests, and career aspirations. Here are some examples of how this can be achieved:

| Course Selection | Purpose | Possible Job Role |

|---|

Analytics

Minor (30 cu) | Apply analytics to financial data to derive information for decision making in trading, investment, risk management or regulatory compliance. | Financial Analyst, Quantitative Analyst, Risk Analyst, Financial Planner, Investment Banking Analyst

|

Information Technology

Minor (30 cu) | Open up a wide range of career opportunities that leverage both financial expertise and technical skills.

| Financial Analyst specialising in FinTech, Financial Consultant specialising in Information Security, FinTech Entrepreneur, Financial Systems Analyst |

Accounting or Applied Economics

Minor (30 cu) | Develop a robust foundation to analyse companies within their economic context using financial statements.

| Financial Analyst, Corporate Finance Analyst, Risk Analyst |

FinTech or Supply Chain Management

Minor (30 cu) | Build a strong foundation to proficiently analyse finance within the context of contemporary supply chains, integrating innovative blockchain applications. | Financial Analyst with Supply Chain Focus, Supply Chain Finance Manager, Investment Analyst with FinTech Focus

|

Marketing

Minor (30 cu) | Open up various career opportunities in both finance and marketing-related fields. | Financial Planner, Wealth Manager, Financial Sales Representative, Commercial Banker |